Investor Experience Index: The Role of Anonymity in Investor Feedback (Q1 2025)

Never miss an Invest Clearly Insights article

Subscribe to our newsletter today

In analyzing review patterns from retail real estate investors, a striking relationship emerges between rating sentiment and reviewer anonymity. While all reviewers on the Invest Clearly platform are verified, individual investors can choose whether to display their names publicly. This choice reveals a compelling pattern about how retail LPs provide feedback.

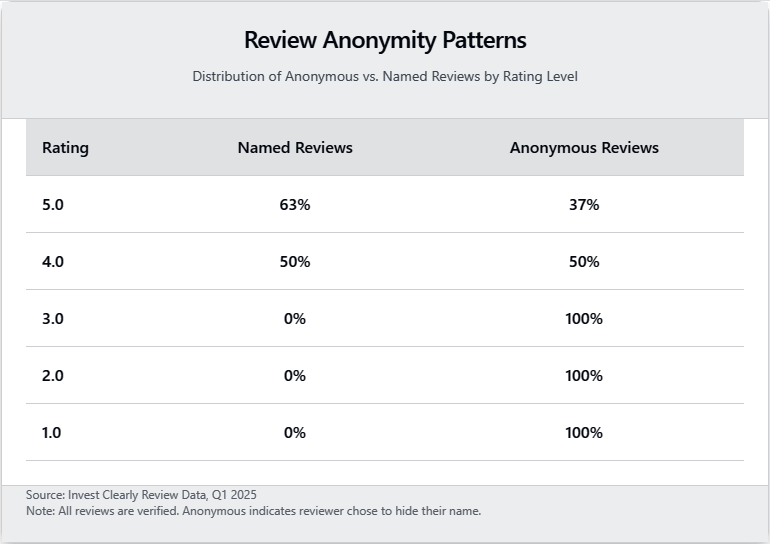

The data shows a clear correlation between review sentiment and anonymity preference:

- 100% of reviews rating 3-stars or below are submitted anonymously

- Only 37% of 5-star reviews are anonymous

- Named reviewers exclusively provide 4 or 5-star ratings

This stark pattern manifests in the overall metrics:

- Named Reviews Average: 4.97/5.0

- Anonymous Reviews Average: 3.84/5.0

The disparity extends beyond just overall ratings. Anonymous reviews show consistently lower scores across all metrics:

- Pre-investment Communication: 4.39 vs 5.00

- Post-investment Communication: 3.95 vs 4.96

- Leadership Assessment: 3.77 vs 4.99

- Expectation Alignment: 3.63 vs 4.94

This pattern suggests a fundamental dynamic in the retail investor-sponsor relationship: individual investors appear hesitant to publicly criticize sponsors. The data implies that anonymity serves as a crucial mechanism for surfacing honest, critical feedback in an industry where individual investors might feel vulnerable about potential repercussions or future investment opportunities.

For sponsors, this insight has important implications. Anonymous feedback channels might reveal more candid assessments of their performance, particularly from retail investors who might otherwise remain silent about their concerns. For prospective investors conducting due diligence, it suggests that examining both anonymous and named reviews provides a more complete picture of sponsor performance.

The findings raise broader questions about transparency and feedback in private real estate investment: Does the power dynamic between retail investors and sponsors inhibit open communication? Are current feedback mechanisms adequately protecting individual investors while encouraging honest feedback? The data suggests that anonymous review options play a crucial role in surfacing the full spectrum of retail investor experiences.

Written by

Invest ClearlyInvest Clearly empowers you to make informed decisions by hosting unbiased reviews of passive investment sponsors from verified experienced investors.

Other Articles

Investor Experience Index Q2, 2025: LP Takeaways

Our analysis and evaluation of trends observed in verified investor reviews in Q2, 2025. Here’s what LPs can learn from the data and the questions to ask sponsors when evaluating deals.

What Needs to “Die” in Passive Investing – According to Guests of The Invest Clearly Podcast

Get the answer to the closeout questions of each podcast episode: “What do you think needs to die in passive investing?” The answers are wide-ranging, from misconceptions about risk, to misleading marketing tactics, to structural issues in how deals are presented.

Passive Real Estate Investing Advice from Experienced LP Investors

Experienced LPs shared their most valuable lessons, drawn from years of investing across various asset classes and sponsor relationships.

The Equal Opportunity for All Investors Act: A Practical Guide for LPs

If the Equal Opportunity for All Investors Act of 2025 is enacted, the law would add a new knowledge-based path to accredited investor status. As a result, individuals who previously were excluded from private investments would have the option to gain access through a new SEC examination that would then be administered by a registered national securities association at no cost to applicants.

What Is an Accredited Investor?

Understanding what is accredited investors, how the federal securities laws and the SEC accredited investors definition works, and what it takes to meet the accredited investors requirements is essential if you want to move beyond traditional stocks and bonds and into private markets.

A Guide to Real Estate Investing with a Self-Directed IRA

An SDIRA enables investors to go beyond Wall Street and build wealth through alternative assets like private real estate. This guide will explain how you can use an SDIRA to passively invest in real estate syndications, offering diversification and potential tax advantages for your long-term financial goals.